NEWS

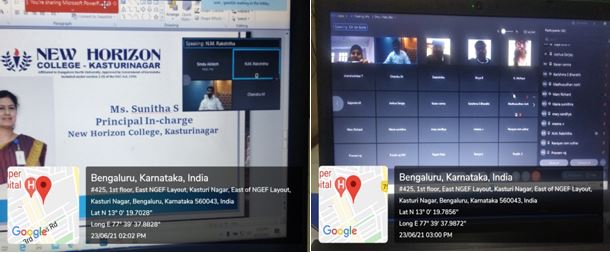

WEBINAR- INSIGHTS INTO FIVE HEADS OF INCOME TAX

Date: 23rd June 2021

Mode and Link: Cisco WebEx – https://meet87.webex.com/meet/pr1420742296

Conducted by: Department of Management

Attended by: VI SEM BBA (75 students)

Time: 2.00 am -3.00 pm

OBJECTIVE: To get familiarized with the purpose of charging tax and computation of Total income

A thought-provoking session on “insights into five heads of income tax” was held on 23rd June 2021 for students of, VI semester BBA. The resource person was Mr. K Gulia, M.Com (Finance & Tax), ACA.

Highlights of the session

Section 14 : 5 Heads of Income Under Income Tax Act 1961. Section 14 of the Income Tax Act is for computation of income under five heads. All Income Shall, For The Purposes Of Charge Of Income-Tax And Computation Of Total Income, Be Classified Under The Following Heads Of Income :—

- Income from House Property.

- Profits and Gains of Business or Profession.

- Capital Gains.

- Income from Other Sources.

Points Discussed

The resource person highlighted the following points:

Income from salary:

Section 15 to section 21 relate to income charged under the head salary. Salary includes basic salary or wages, any annuity or pension, gratuity, advance of salary, leave encashment, commission, perquisites in lieu of or in addition to salary and retirement benefits.

Income from house property

Income from any residential or commercial property is charged to tax under section 22 to section 27 of the Income Tax Act. In fact, if one own more than one house, barring one, other properties are charged to tax despite the fact that the house may not be put on rent.

Income chargeable to tax under the head “Income from House Property is computed as Annual Value and is the higher of the fair rental value, rent received or municipal rent. Standard deduction of 30% is allowed on the ALV. Further, one can reduce the interest on borrowed capital.

Profits and gains of business or profession

Income earned through your profession or business is charged under the head “profits and gains of business or profession”. The income chargeable to tax is the difference between the credits received on running the business and expenses incurred.

Capital gains

Section 45 is the charging section for capital gains. Any profit or gain arising from transfer of capital asset which is defined under section 2(14) held as investments are chargeable to tax under the head “capital gains”. The capital gains are charged to tax under two sub-heads -short term capital gains or long term capital gains. Further, Income Tax Act also provides the special rate of tax for charging tax on capital gains on shares and mutual funds.

There is tax exemption from long term capital gains on sale of residential house or other capital asset or even agriculture land under section 54 or section 54F or section 54EC or section 54B of the Income Tax Act

Income from other sources

Any income that does not fall under the four heads above is taxed under the head “income from other sources”. An example is interest income from bank deposits, winning from lottery, any sum of money exceeding Rs. 50,000 received from a person (other than from relative, on marriage, under a will or inheritance)